tax avoidance vs tax evasion australia

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. The line between tax avoidance and tax evasion can be very thin and at times indistinguishable.

How Can The Eu Achieve A Fair Distribution Of The Tax Burden Susanne Wixforth

The tip-off form only takes a few minutes to complete.

. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. There are many legitimate ways in. Tax avoidance is lawful and tax evasion is unlawful.

In Australia tax fraud is criminalized by both the Federal Government and State Governments. The majority of clients seek advice regarding day-to-day business transactions. If you have information about someone you think may be participating in phoenix tax evasion or shadow economy activity you can report it to us confidentially online.

Difference Between Tax Evasion and Tax Avoidance. However while tax avoidance doesnt break the law it still neglects the. But its not quite as simple as that.

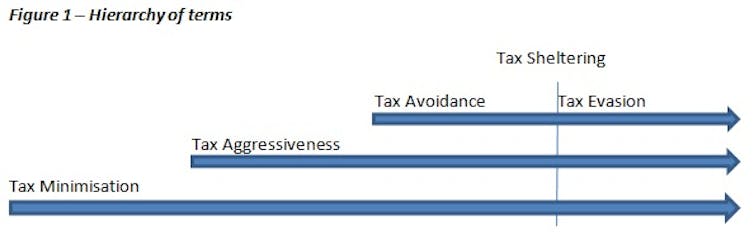

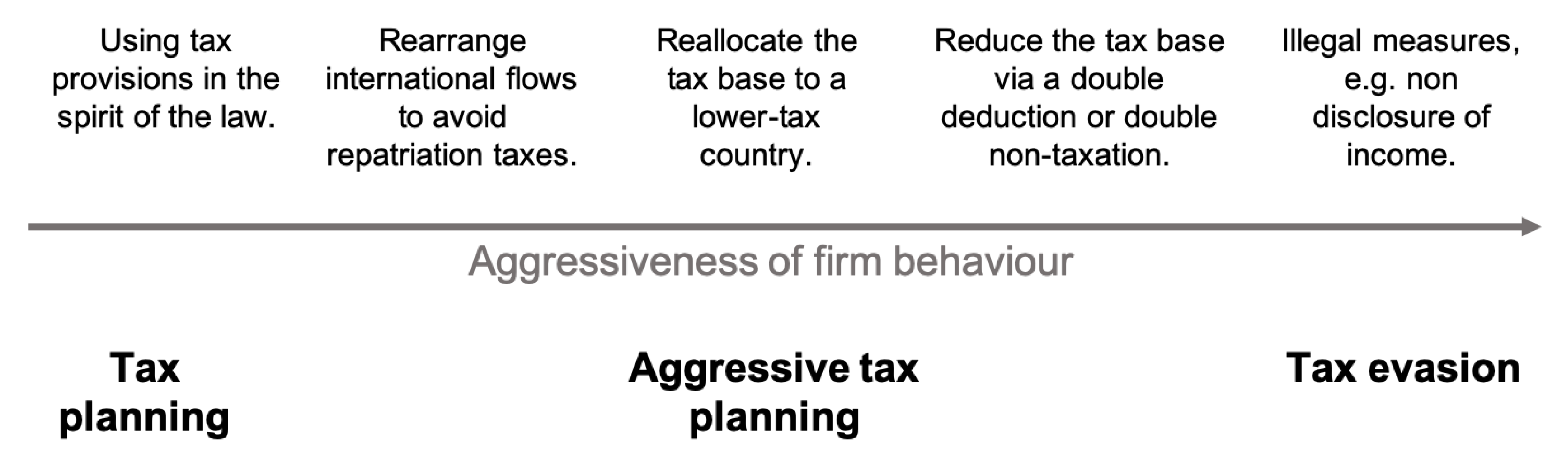

However it is not always clear how the two concepts are distinguished. TA 20211 Retail sale of illicit alcohol. Tax planning is a legitimate practice aimed to minimise tax liabilities through activities that are allowed under the law.

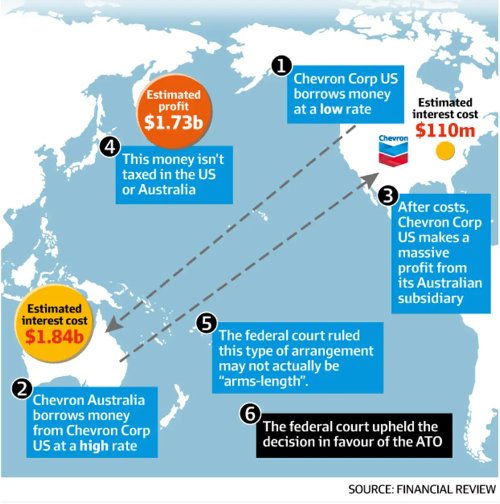

The test applied in judicial determinations is based on the dominant purpose of a transaction or activity and this concept underlies the anti-avoidance provisions Part IVA of the tax legislation. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. Tax evasion means concealing income or information from tax authorities and its illegal.

However for some time the Australian Government has ignored the difference between the two concepts when it comes to Australians using tax havens and being investigated as part of Project Wickenby1The Australian Government is deliberately labelling. Tax evasion and multinational tax avoidance Treasurygovau. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget.

The basic difference is that avoidance is legal and evasion is not. In fact the line between the two can almost be invisible to the ordinary eye. The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments.

There is a fundamental difference between tax planning and tax evasion. Tax evasion is a serious offense and those found guilty can be fined andor jailed. Common tax avoidance arrangements.

TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax. Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of. TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments.

Setting aside the tax evasion both tax planning and tax avoidance are legal. Hopefully the illustration above can give you a clear picture of the difference between tax planning tax avoidance and tax evasion. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system.

Avoidance meant arranging your affairs so tax wasnt due. 37 ATR 321 at 323 Gleeson CJ said Tax evasion involves using unlawful means to escape payment of tax. Australian media mogul Kerry Packer used the distinction as a complete defence when he told a parliamentary committee in 1991 he was not.

Many different Federal and State offences fall under the. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments. However the ATO closely examines schemes and.

Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment. To start with tax avoidance is legal while tax evasion is illegal. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of.

A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of. Commonly referred to as tax minimisation tax avoidance strategies have a low chance of being red flagged in tax audits as compared to blatant misrepresentations. Australias legislative references to tax evasion do not refer to a criminal offence or even a category of criminal offences.

Try to provide as much detail as you can so we are able to fully assess the information see Making a tip-off. Whereas tax evasion is unlawful. Tax avoidance means legally reducing your taxable income.

Imprisoned for up to five years. Basically tax planning is legal tax evasion is illegal and tax avoidance is somewhere in between. Fined up to 100000 or 500000 for a corporation.

Whilst tax evasion is illegal tax avoidance is not. II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. A taxpayer charged with tax evasion could be convicted of a felony and be.

Or both and be responsible for prosecution costs. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion.

There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty. The government has enacted general and specific anti-avoidance provisions.

Explainer What S The Difference Between Tax Avoidance And Evasion

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Tax Avoidance Png Images Pngwing

Which U S Companies Have The Most Tax Havens Infographic

Tax Evasion Statistics 2022 Update Balancing Everything

Explainer The Difference Between Tax Avoidance And Evasion

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Tax Avoidance Png Images Pngwing

Tax Avoidance Vs Tax Evasion Expat Us Tax

What Is The Difference Between Tax Evasion And Tax Avoidance

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times